In the latest Rent vs. Buy Report from Trulia, it was noted that homeownership remains cheaper than renting with a traditional 30-year fixed rate mortgage in the 100 largest metro areas in the United States.

The updated numbers show that the range is an average of 6.5% less expensive in San Jose (CA), all the way up to 50.1% less expensive in Detroit (MI), and 37.4% nationwide!

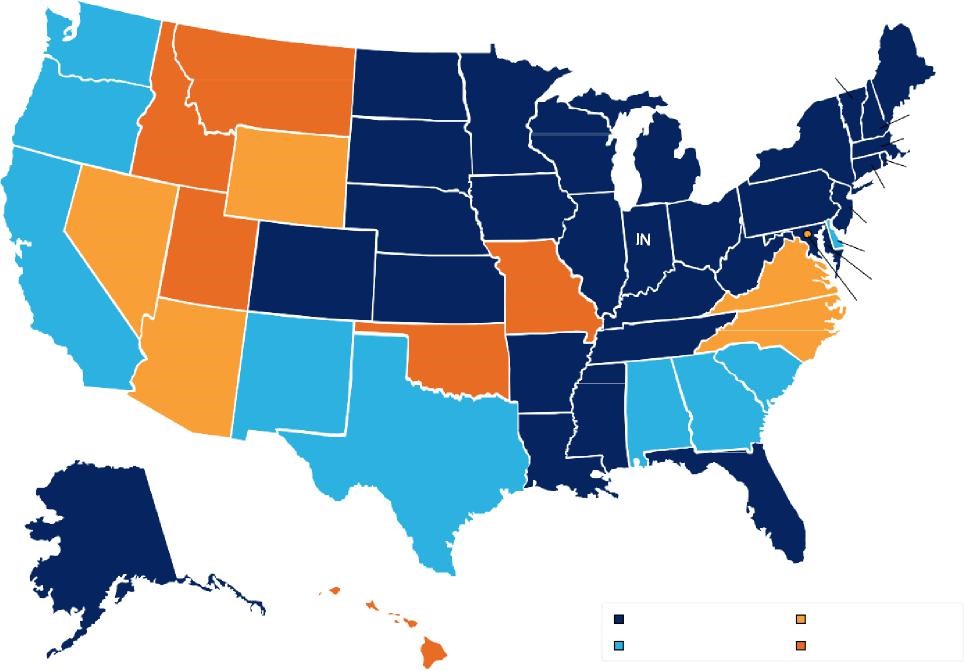

A study by GoBankingRates looked at the cost of renting vs. owning a home at the state level and concluded that in 39 states, it is actually ‘a little’ or ‘a lot’ cheaper to own (represented by the two shades of blue in the map below).

On of the main reasons that buying a home is cheaper than renting is the fact that interest rates are still at historical lows. The current average 30 year fixed mortgage rate is around 4%. In most states, interest rates would have to reach 9% for renting to be cheaper than buying.

If buying a home makes sense to you, let’s get together and find you your dream home.